ny paid family leave tax code

If your employer participates in New York States Paid Family Leave program you need to know the following. What category description should I choose for this box 14 entry.

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Verify the New York Paid Family Leave item are there.

. For 2022 the SAWW is 159457 which means the maximum weekly benefit is 106836. Here are the key points. Not that anyone in New York.

Bond with their child during the first 12 months after birth adoption or fostering of a child. This is 9675 more than the maximum weekly benefit for 2021. Assist loved ones when a spouse domestic partner child or parent is deployed abroad on active military service.

Use of NY Family Leave. NYGOVPAIDFAMILYLEAVE PAGE 1 OF 2 NEW YORK STATE PAID FAMILY LEAVE. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017.

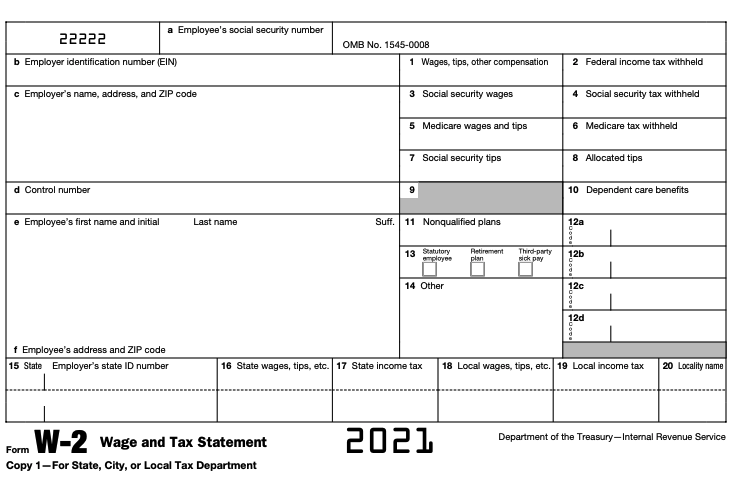

However premium for paid family leave is treated as the payment of a New York state tax. N-17-12 PDF Paid Family Leave contributions are deducted from employees after-tax wages. NYPFL in Box 14 of your W-2 should be listed under the category of Other deductible state or local tax when you are entering your W-2 on the federal screen.

Employee-paid premiums should be deducted post-tax not pre-tax. W A Harriman Campus Albany NY 12227 wwwtaxnygov N-17-12 Important Notice August 2017 New York States New Paid Family Leave Program The States new Paid Family Leave program has tax implications for New York employees employers and insurance carriers including self-insured employers employer. Go to Employees and select Employee Center.

This will increase incrementally to 12 weeks and 67 of the state average weekly wage by 2021. In 2022 the employee contribution is 0511 of an employees gross wages each pay period. EMPLOYEE CONTRIBUTION Employers may collect the cost of Paid Family Leave through payroll deductions.

Currently the average weekly wage is 130592 which means the maximum weekly pay that employees can receive while on leave is 65296 for 2018. Like the California tax the program should add it to Schedule A taxes. On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave.

On August 25 2017 the New York State Department of Taxation and Finance DFS released highly anticipated guidance regarding taxation of PFL benefits and premium in Notice N-17-12. 1 Obtain Paid Family Leave coverage. Employee Notice of Paid Family Leave Payroll Deduction for 2022 PDF.

The original Turbo Tax answer about a year ago to this question was incorrect which is why I responded as I did with the correct info and the NYS link stating that NYPFL is a. Select OK twice to close the window. What category description should I choose for this box 14 entry.

Vacation and Personal Leave. New York Enacts Paid Family Leave Program. Private insurers must report.

The maximum annual contribution is 42371. Your employer will not automatically withhold taxes from these benefits. Requirements for other types of employers are dependent upon the type of.

This deduction shows in Box 14 of the W2. The maximum employee contribution in 2018 shall be 0126 of an employees weekly wage up to the annualized New York State Average Weekly Wage. Double-click the employees name to open the Edit Employee window.

3 Complete the employer portion of the Paid Family Leave request form when a worker applies for leave. Employers may offer employees the option of using any accrued unused paid vacation or personal. Paid Family Leave may also be available.

What category description should I choose for this box 14 entry. Use the calculator below to view an estimate of. Paid Family Leave provides eligible employees job-protected paid time off to.

This amount is under the annualized cap of 8556 so Barbara has a payroll deduction of 126 per week through the entire year. Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or. You may request voluntary tax withholding.

The program provides up to 12 weeks of paid family leave benefits paid at 67 of the employees average weekly wage up to a pre-determined cap to most employees in New York. Any benefits you receive under this program are taxable and included in your federal gross income. Pursuant to the Department of Tax Notice No.

Year Duration Wage Replacement 2018 8 weeks 50 of the employees average weekly wage or 50 of the statewide average weekly wage whichever is less 2019 10 weeks 55 of the employees average weekly wage or 55 of the statewide. For the last couple of years NYS have being deducting premiums for the Paid Family Leave program. Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW.

On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. 100000 weekly salary x 4333 433300 monthly salary x 00126 546 monthly premium due. Use Paid Family Leave.

Paid family leave benefits are not treated as disability benefits for any tax purpose. Select the Payroll Info tab and select Taxes. Now after further review the New York Department of Taxation and Finance has provided important guidance regarding payroll deduction and PFL taxation.

In the Taxes screen that pops up select the Other tab. During leave taken in 2018 employees receive 50 of the state average weekly wage for up to eight weeks. To update your rate or add your account.

The law allows eligible employees to take paid family leave to. In 2021 these deductions are capped at the annual maximum of 38534. New York designed Paid Family Leave to be easy for employers to implement with three key tasks.

2021 Paid Family Leave Payroll Deduction Calculator If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period. Ask questions get answers and join our large community of tax professionals. A brief outline of New York Paid Family Leave.

You will receive either Form 1099-G or Form 1099-MISC. Download about PFL At-A-Glance PDF Reports NYS Paid Family Leave Arbitration 2021 Q2 Report PDF Review of denials and other claim-related Paid Family Leave PFL disputes are handled by NAM National Arbitration and. Benefits paid to employees will be taxable non-wage income that must be included in federal gross income.

67 of the employees average weekly wage or 67 of the statewide average weekly wage whichever is less. Barbara makes less than 6790784 per year. Employees earning less than the Statewide Average Weekly Wage SAWW.

Employers paying self-funded benefits should report benefits paid to an employee as non-wage income on the employees W-2 form. 2 Collect employee contributions to pay for their coverage. At end of year Barbara pays a total of 6552.

On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. On the 2020 edition there is no Other option please see the screenshot above.

Get Ready For New York Paid Family Leave In 2021 Sequoia

State Rankings On Economic Well Being For Children 2013 From The 2013 Kids Count Data Book From The Annie E Casey Foun Counting For Kids Kids Health Health

The Economy Is Looking Awfully Strong Economy The Expanse House Styles

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Paid Family Leave For Family Care Paid Family Leave

Pin On From Spinoza To Einstein And More

How To Read Your W 2 Justworks Help Center

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

The Economy Is Looking Awfully Strong Economy The Expanse House Styles

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Cost And Deductions Paid Family Leave

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

Education Cost Split By State Higher Education Public University Education